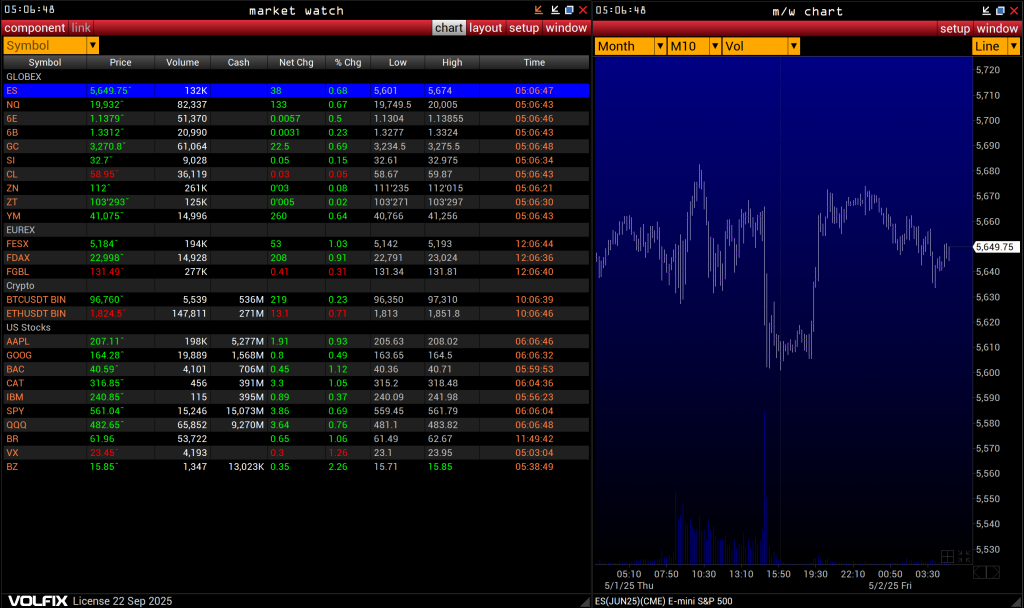

In the first part of this article, titled Market Watch – the core of the VolFix, we gave a general overview of this key component of the VolFix trading and analytical platform. Now let’s focus on the top section of the Market Watch window, as it contains some of the most essential functions we use regularly — whether for volume analysis or executing trades.

Market Watch – Access to platform settings and components.

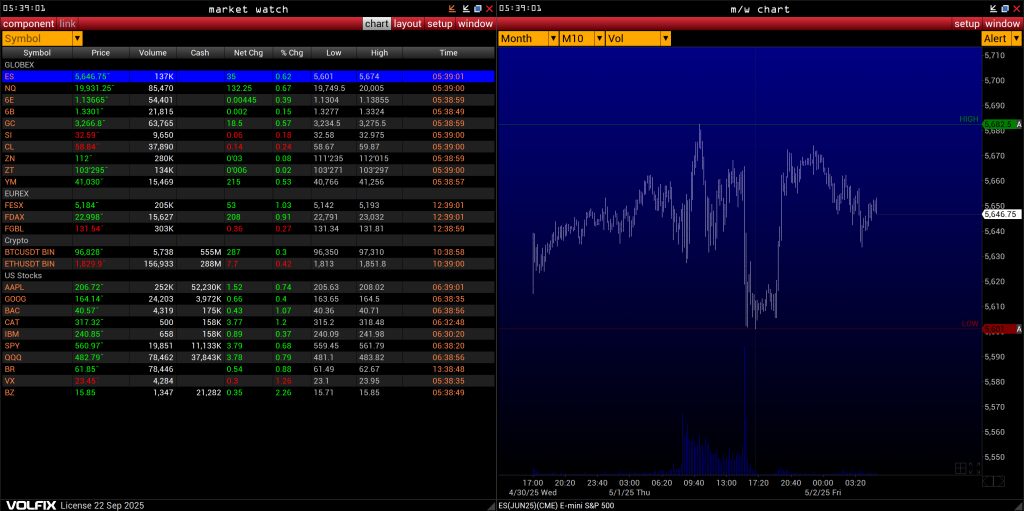

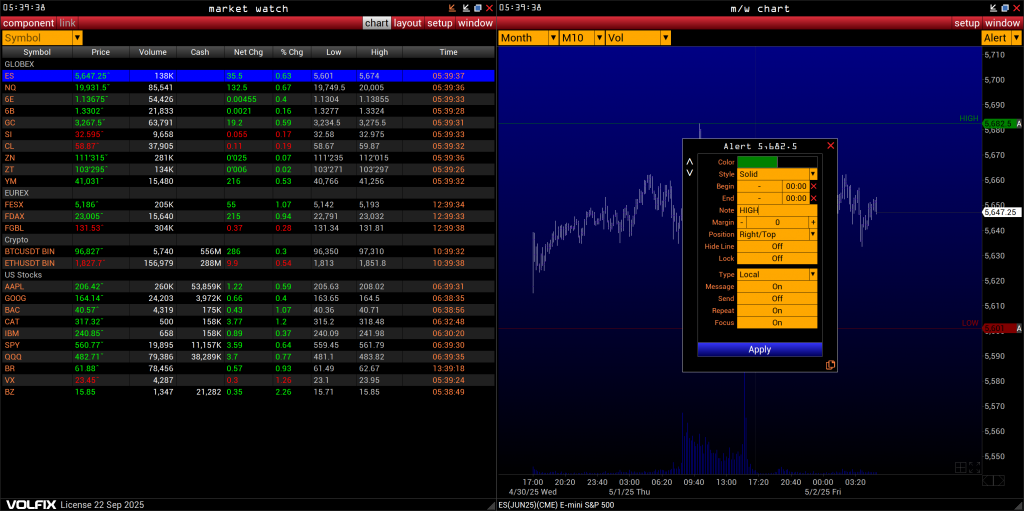

The very top line of the window displays service information: exchange time, the window title, and standard window control buttons (minimize all, minimize window, maximize to full screen, and close).

It’s important to note that in the case of the Market Watch, clicking the “close” button will shut down the entire VolFix platform. However, if you click it by accident, the program will ask for confirmation before proceeding, giving you a chance to cancel the action.

As for the exchange time indicator, the displayed time updates based on the active row in the ticker field. That said, if you’ve enabled the “Time” column, you’ll already see the relevant market time for your selected asset.

The next row in the Market Watch window contains the following menus: “Component” and “Link” on the left, and “Chart,” “Layout,” “Setup,” and “Window” on the right.

The “Component” Menu.

The “Component” menu gives you access to almost the entire VolFix functionality. Here you can open chart windows, statistical tables for market data analysis, volume event filters, the alert management server, the Trading Depth of Market module, trade reports from Liberty Market Investment, and many more components. Each of these tools deserves its own detailed explanation, which we’ll cover in future articles.

Note: In the “Statistics” section of this menu, you may also see an item named “Market Watch.” This is not a separate module — it’s the same Market Watch window you’re currently working with. VolFix allows you to open multiple Market Watch windows simultaneously, which is especially useful for traders and investors tracking large groups of assets. For example, stock traders who monitor dozens or even hundreds of tickers across sectors and correlated instruments for risk hedging can set up multiple windows for better organization. When combined with the “Link” function, this becomes a powerful workspace tool.

The “Link” Button.

This button allows you to manage sets of windows through a desktop management system. It’s an essential tool for active traders using volume-based strategies and helps optimize screen space — especially useful if you’re working from a single monitor or laptop.

The “Chart” Button.

Clicking “Chart” opens a basic bar chart window for the selected ticker in your ticker list. While this chart isn’t meant for advanced volume visualization, it’s a good tool for tracking price movements and setting alerts — especially when you’re monitoring many instruments simultaneously.

The “Layout” Button.

This may be one of the most important features in VolFix. As you work in the platform, you’ll inevitably make changes — tweaking default settings, reorganizing components, fine-tuning your workspace for your specific trading and analytical needs. To preserve this custom setup, use “Layout” to save your progress.

Each time you save your Layout before exiting, you’re preserving your workspace — including open windows, selected instruments, custom drawings, chart annotations, and more.

Don’t forget to save your layout before exiting VolFix!

VolFix also provides protection against accidental loss of your Layout. There’s an auto-save feature, but it doesn’t guarantee the latest changes are always preserved — so it’s still best to manually save. What’s more, all your Layouts are stored on VolFix servers, meaning you can access your personal configuration from any device, anywhere in the world. No more USB drives or manual transfers — just launch VolFix and load your saved Layout.

Note: If your original Layout was designed for a triple-monitor setup, but now you’re using just a laptop screen while traveling, the window layout won’t fit automatically. You’ll need to reorganize it manually to fit the smaller screen. VolFix keeps all window settings and chart data intact — but screen placement is up to you.

Creating multiple Layouts for different asset groups, market sectors, or device setups is a smart approach.

Market Watch – The “Setup” and “Window” Buttons.

The “Setup” button gives you access to a wide range of global settings that affect how the platform and its components function and display. In practice, once you configure these settings, you likely won’t need to revisit them often. Most ongoing adjustments are made using the Setup button inside individual components. Still, there are a few options in the main Setup menu you might access more frequently.

As for the “Window” button — it displays a catalog of all currently open windows in VolFix. This button is available in every window, so you don’t need to go back to Market Watch to access it. You can scroll through the list using your mouse wheel or close any window directly from this menu by clicking the red “X” on the right.

Settings for this catalog are controlled from the “Setup” menu in the Market Watch, but there are only a few basic options (mainly sorting).

Currently, VolFix supports up to 200 simultaneously open windows. However, to handle that volume of real-time market data, your PC or laptop will need to be very high-performance. That said, it is possible — if needed.

Market Watch – Conclusion (though it is still very far off).

You now have a first-level understanding of the Market Watch window. Future articles will explore its features in greater depth. But at this point, you already know what the main buttons do and how they can support your daily trading workflow.

Thank you for your attention.

The VolFix Team

📌 VolFix Academy: If you want to master volume charts, cluster visualizations, understand the behavior of large market participants, and find optimal entry points, VolFix offers all the tools you need for in-depth liquidity analysis, whether it’s Footprint, Cluster, DoM or Smart Tape.

It is equally useful for beginners and professionals who want to improve the accuracy of their trading, make decisions based on objective data rather than subjective judgments, and avoid unnecessary losses.